The world we live in looks richer on the surface, yet it feels poorer. Storefronts are full of new gadgets, there are more cars on the streets, and salaries—in numerical terms—are higher than they were ten years ago. But here is the paradox: most people feel stagnation rather than growth. It seems that the more you earn, the less remains.

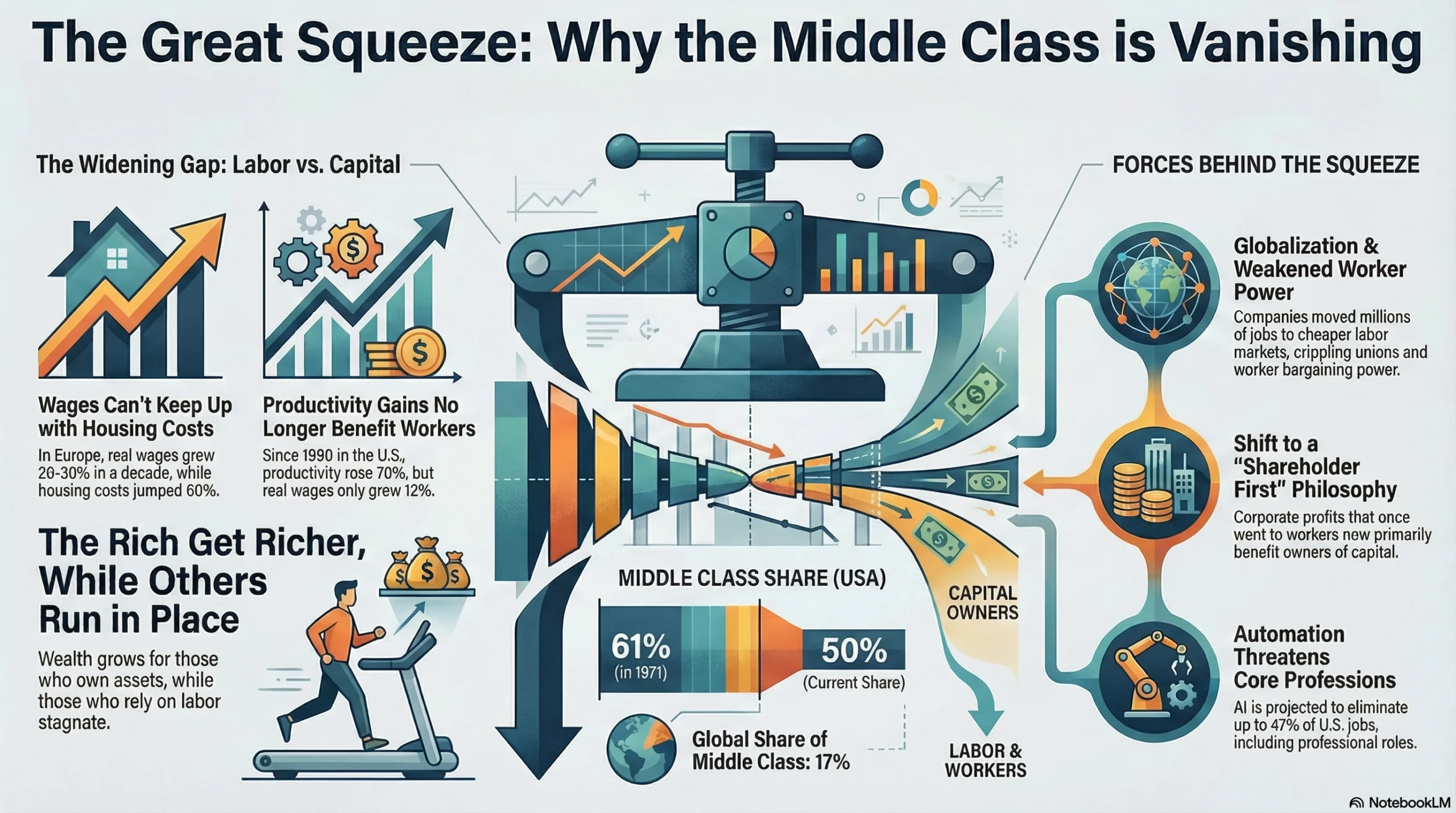

It sounds absurd, but this is the reality. In Europe, for example, real wages have grown by only 20-30% over the last decade, while housing prices have skyrocketed by nearly 60%. Do you see the pattern? Income grows at a snail’s pace, while everything else grows exponentially. Interestingly, typical salaries increasingly fail to cover basic needs: groceries, rent, fuel, and so on.

Hidden behind this is a much deeper shift than appears at first glance: the disappearance of the middle class. This is the very stratum that used to ensure economic stability, confidence in the future, and social progress. Somewhere along the line, the wealthy became richer, their assets growing on their own, while the rest work harder but fail to move forward.

This is the main riddle of our time. How did it happen that some get rich simply by owning assets, while others run faster only to stay in place? What happened to an economy where labor effectively ceased to mean prosperity?

The Rise of the Middle Class

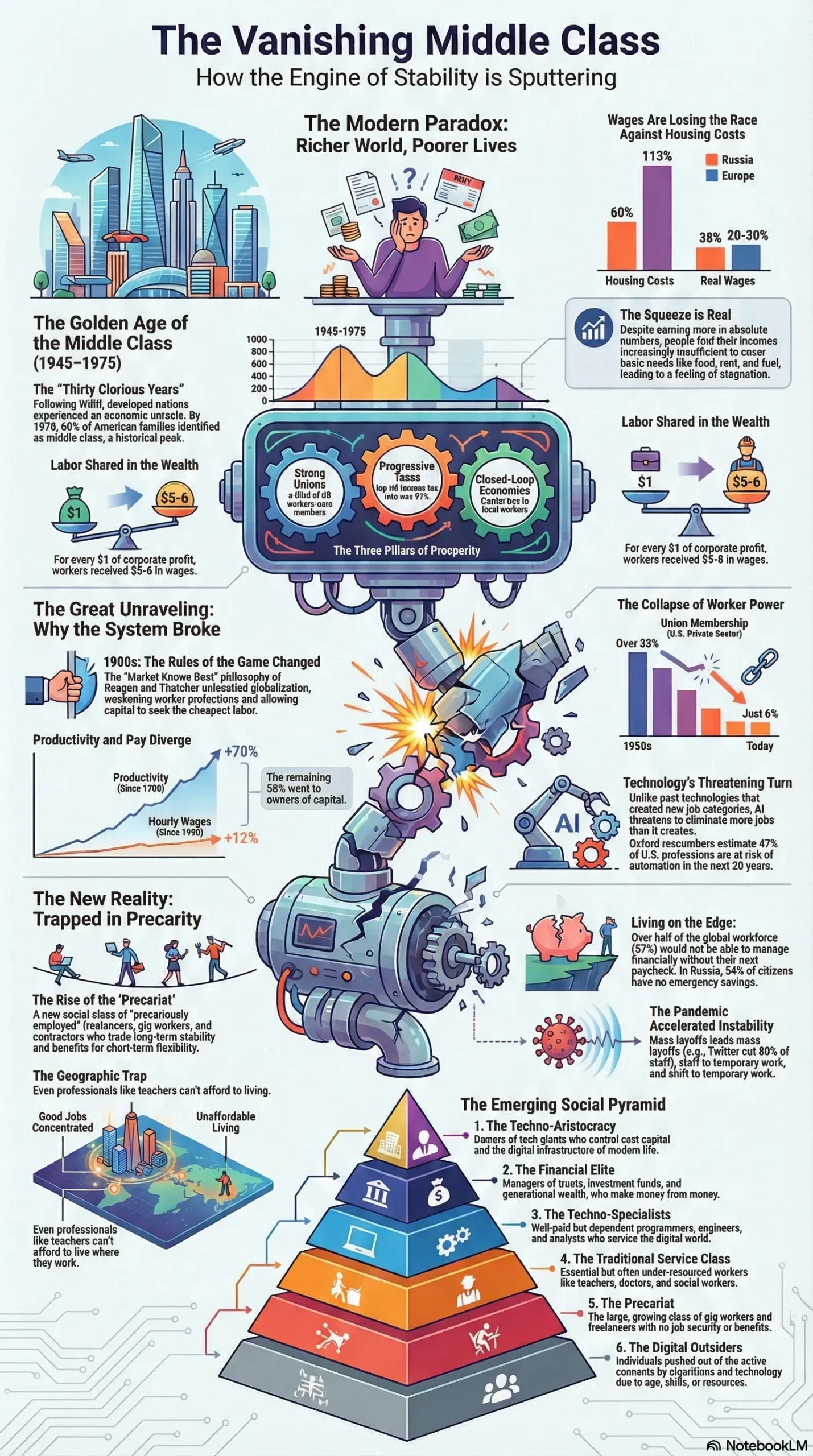

The middle class is actually a historical phenomenon. For most of human history, it simply didn’t exist. Imagine society as a multi-story building. In antiquity and the Middle Ages, the structure was simple: a mass of slaves or peasants at the bottom, a handful of wealthy aristocrats at the top, and almost a void in between. There were only thin layers of artisans and merchants, too few to affect the stability of the entire structure.

Everything changed in the 19th century. The Industrial Revolution created a mass of new professions. People appeared who earned more than peasants through their labor, but still less than aristocrats. This new social group needed a name, and in 1813, the Oxford Dictionary first recorded the term “middle class.”

The true triumph of the middle class occurred after World War II. The French called the period from 1945 to 1975 the “Thirty Glorious Years.” In the US, the average worker’s salary doubled, and by 1970, 60% of American families belonged to the middle class—more than ever before in human history.

An ordinary teacher could buy a house in the suburbs, support a family of four, change cars every two years, and save for retirement. An engineer lived better than a 15th-century nobleman. This didn’t happen by itself; several powerful factors were at play:

- Strong Unions: In 1955, a third of American workers belonged to unions.

- The Unspoken Contract: Until 1979, if a company became more profitable, workers automatically received a pay raise. Workers received about two-thirds of the wealth the economy created.

- Progressive Taxation: High tax rates on the ultra-wealthy (at one point reaching 91% in the US) funded roads, schools, and hospitals that benefited everyone.

- A Closed Economy: Factories couldn’t easily flee to cheaper jurisdictions because global capital wasn’t yet fluid.

It was a beautiful mechanism: corporations grew, workers earned more, spent more, and this fueled further corporate growth. But in the 1980s, this mechanism broke.

The Slow Displacement

The decline began with the “Quiet Revolution” of the 1980s. Ronald Reagan and Margaret Thatcher proclaimed a new economic religion: the market knows best.

It started with a simple question: Why pay an American worker $7 an hour if a worker in China in 1985 received less than a dollar for the same job? The result was predictable. Factories moved to Asia. Cities like Detroit and Pittsburgh were devastated.

Simultaneously, unions were dismantled. Without collective power, individual workers could not bargain with corporations. Furthermore, the wealthy received tax holidays. The maximum income tax rate dropped drastically, and taxes on capital gains were slashed. Consequently, many billionaires began paying lower tax rates than their own secretaries. Money that used to go into the country’s common pot now settled in private pockets.

Most importantly, the philosophy of business changed. Previously, corporations felt responsible to everyone: shareholders, employees, and society. Now, they are responsible only to shareholders. Since 1980, labor productivity in the US grew by 70%, while wages grew by only 12%. Where did the other 58% go? To the owners of capital.

The Technology Trap

We are now witnessing a technological revolution that is completing the transformation of the economy. Previously, technology created more jobs than it destroyed. When cars replaced horse-drawn carriages, new professions appeared: drivers, mechanics, road workers. Computers replaced typists but created the IT industry.

Artificial Intelligence works differently. It creates far fewer new professions than it destroys. What used to take a lawyer a day, AI now does in seconds. Oxford scientists have calculated that 47% of professions in the US could disappear in the next 20 years.

This time, the “white collar” jobs are under attack: accountants, lawyers, financial analysts—the very core of the middle class. The economy grows, corporations get richer, but real incomes stagnate.

The Matthew Effect: Why the Rich Get Richer

There is a parable in the Gospel:

"For to everyone who has will more be given... and from the one who has not, even what he has will be taken away."

Economists call this the Matthew Effect.

If you have money, you can make it work. If you don’t, you work for other people’s money. The Walton family (owners of Walmart) increased their fortune by billions simply by owning shares, while millions of employees created that value. Wealthy families create trusts and funds to protect capital from taxes and inflation, allowing money to work for money, generation after generation.

For the ordinary person, the game is rigged against saving. Inflation devours savings. While you spend 15 years saving for a home, the person who bought real estate earlier has seen their capital multiply simply by owning it.

This widening gap creates a hereditary system. In the past, a talented student could rise through free education and social lifts. Today, that same student graduates with massive debt, while their classmate from a wealthy family already owns an apartment bought by their parents. By age 30, one has an asset growing in price, the other has debt eating their income. Social mobility has frozen.

The Pandemic Accelerant

The COVID-19 pandemic became a test that broke millions. Central banks turned on the printing presses. The US poured trillions into the economy, but the money didn’t go where it was needed. Small businesses went bankrupt while large corporations got cheap loans and grew richer.

What did ordinary people get?

Inflation.

By 2022, prices skyrocketed.

Moreover, the pandemic accelerated digitalization by a decade. Companies realized they didn’t need huge offices or fully staffed departments. Mass layoffs followed at major tech companies, not due to crisis, but for “efficiency.”

The most brutal blow fell on the survivors. The middle class is being turned into an army of freelancers and contractors. Companies shifted responsibility to agencies while keeping the flexibility for themselves. A Google programmer on a contract might sit next to a staff member but receive fewer benefits, less pay, and have no job security.

Where is the Middle Class Going?

A large portion of the population is simply drowning in debt. Globally, a significant percentage of workers cannot survive without their next paycheck. In Switzerland—one of the richest countries—household debt is 130% of GDP.

Expenses are rising faster than income: rent, utilities, food, fuel, subscriptions, delivery. Separately they seem small, but together they are overwhelming. People spend savings, then take loans for vacations or phones, and eventually live in debt. You might formally be middle class—you have a job, a car, an apartment—but actually, you are entirely dependent on the banking system.

Those who avoid the debt trap often fall into the Precariat.

This term describes a class of unstable employment: freelancers, gig workers, and temporary contractors. They might earn decent money, but they have no guarantees. The “Gig Economy” covers huge swathes of the labor market globally.

People are also falling into “geographic traps.” Good jobs are concentrated in megacities like London or San Francisco, where the cost of living is insane. A teacher in London often cannot afford to rent in the district where they teach.

The New Caste System

We are living through a fracture in eras. The old world of social mobility is dying, and a new caste system is forming on its ruins:

- Techno-Aristocracy: The owners of IT giants who control the digital reality (Google, Meta, Amazon).

- Financial Elite: Managers of trusts and family capital.

- Techno-Specialists: Programmers and engineers who maintain the infrastructure. They are well-paid but dependent.

- Service Class: Teachers, doctors, social workers. Essential, but often overworked and under-supported.

- Precariat: The unstable workforce trading flexibility for security.

- Digital Outsiders: Those pushed out of the active economy by algorithms.

What Can We Do?

Global trends are hard to break alone, but understanding the system gives you an advantage.

- Adaptability: If your industry is threatened, look around. Cybersecurity specialists are needed everywhere. Psychologists and coaches are in high demand as the world becomes more stressful.

- New Trades: A plumber who learns to service smart homes earns significantly more than a colleague who refuses to adapt. Don’t fight technology; learn to use it.

- Investment Strategy: Understand the difference between assets (things that bring money) and liabilities (things that eat money). Fractional shares and modern apps allow investment with small amounts.

- Curiosity: Education no longer guarantees a career, but constant learning does.

The world is changing fast. For those ready to change with it, opportunities still exist. The rules of the 20th century are gone, but new paths are opening for those willing to find them.